Unlocking Yield: A Guide to Minting USST with USDY and the YLD Distribution Mechanism

The document explains the mechanics behind the USST stablecoin Mint and how yield is generated for YLD holders. The process combines the stability of collateralised assets with a dynamic mechanism for harvesting value.

Here is the step-by-step process of how USST is minted using USDY, and exactly how that translates into yield (YLD).

1. The Minting Phase: Turning USDY into USST

The process begins when a user decides to mint USST. Unlike standard deposits, this involves leveraging a specific yield-bearing asset: USDY.

- Deposit: The user deposits a specific amount of USDY units to serve as collateral.

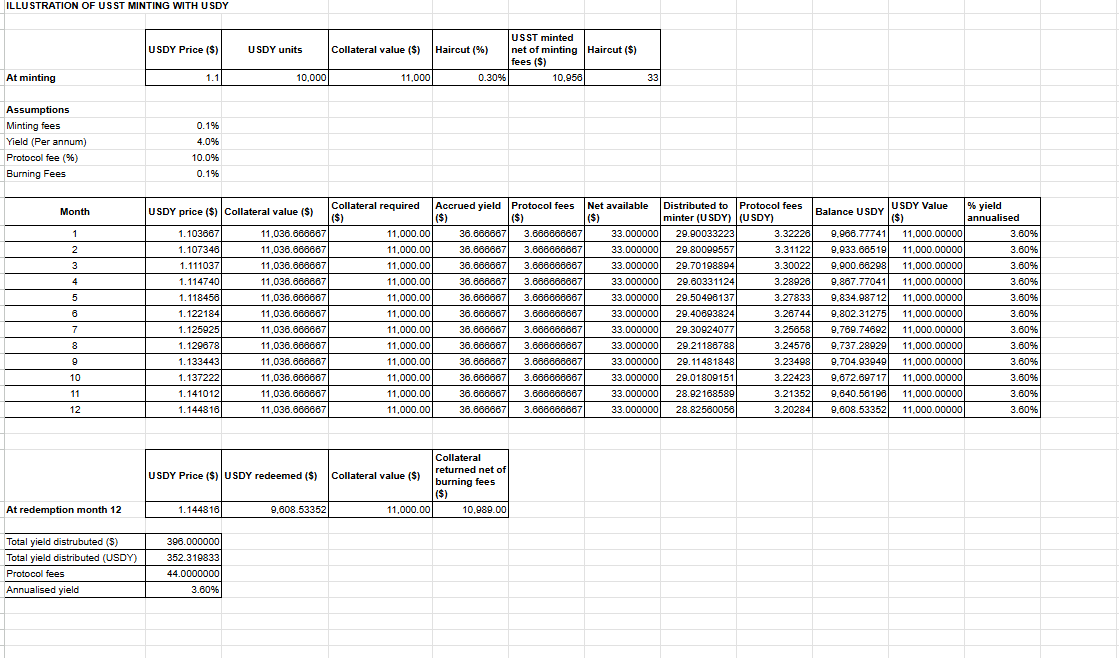

- Calculations and Fees: The protocol does not issue USST at a 1:1 ratio immediately. It applies a "haircut" and minting fees to ensure system solvency. For instance, in a detailed illustration, a deposit of 10,000 USDY units (valued at $11,000) might undergo a 0.30% haircut ($33) and a 0.1% minting fee.

- Issuance: Once these deductions are made, the protocol issues the resulting amount in USST to the user. In our example, the net USST minted would be $10,956.

2. The Growth Engine: USDY Appreciation

Once the USST is minted, the vault holds the underlying collateral (the USDY). This is where the magic happens. USDY is not a static asset; it accrues value over time.

- Accrual: As time passes, the price of the USDY increases. For example, if the USDY price starts at $1.1, it might rise to $1.103667 by Month 1 and $1.107346 by Month 2.

- Collateral Value Increase: Because the USDY price goes up, the total dollar value of the collateral sitting in the vault increases, even though the number of units remains the same (initially).

3. The Extraction: How "Delta" Becomes Yield

The core of the yield mechanism relies on the difference between the current value of the collateral and the required value to back the USST.

- The Check: On a periodic basis, the STBL protocol checks the value of the backing USDY.

- Identifying the Delta: As the yield on USDY increases, the backing value eventually exceeds the value of the issued USST. The protocol identifies this excess value - the "delta" - as transferable yield.

- Extraction: If the backing is greater than the USST value, this delta is extracted from the vault.

4. Distribution: How They Get the YLD

This extracted value is the source of the rewards. The process for distributing this yield is strict and programmatic:

- Transfer to YLD Token: The extracted delta is input directly into the YLD contract.

- Protocol Fees: Before the final distribution, the protocol cuts a fee. Currently, a 10.0% protocol fee is deducted from the accrued yield. For example, if the accrued yield in Month 1 is roughly $36.66, the protocol fee would be about $3.66, leaving a net available amount of roughly $33.00.

- Pro-Rata Allocation: Finally, the USDY yield delta is allocated into the YLD module and is distributed pro-rata to the YLD holders.

- The USDY is kept locked in the YLD module and when a user redeems their YLD and burns the required USST, they receive the accrued yield as USDY.

Summary of the Flow

To visualise the numbers, consider the 12-month trajectory of a 10,000 USDY deposit:

- Start: Collateral value is $11,000.

- During the Year: The USDY price rises monthly (e.g., from $1.1 to $1.144816 by Month 12).

- Result: This price appreciation generates a total yield distribution of roughly $396.00 over the year (after fees), representing an annualised yield of 3.60%.

Disclaimer : Numbers mentioned in the above example are for illustrative purposes only.